Think you have to pay more in taxes?

You don’t. You just need a better plan.

Between ages 45 and 70? The right retirement plan can cut taxable income by $100K-$300K a year—sometimes up to $600K.

How We Build and Manage Your Cash Balance Plan

A five-step process—from feasibility to oversight—designed to help you reduce taxes, stay compliant, and grow wealth with confidence

Feasibility Study

Determine if a cash balance plan is the right fit for your business.

Custom Plan Design

A personalized retirement strategy built around your goals and income.

IRS Compliance & Administration

Stay compliant and confident—your plan is handled by experts.

Investment Management

A professionally managed portfolio aligned with your retirement strategy.

Ongoing Oversight

Annual updates so you can contribute more, less, or stay the course.

$62,000

Average first-year tax savings per client

109+

Plans installed since 2021,

Across farmers, professionals, and business owners.

What our clients are saving

Thanks to my investments and other income, I’m stuck in the higher tax brackets. My cash balance plan saved me over $96,000 in taxes the first year alone.

— Business owner, Chicago

Want to know what your numbers look like? We’ll do the math and show what you could save.

Is a Cash Balance Plan Right for You?

This strategy could be a fit if you…

Earn $300K+ annually

.png?width=97&height=89&name=Group%20(1).png)

Are between ages 45 and 70

Have 0-10 full time employees

Are tired of overpaying the IRS

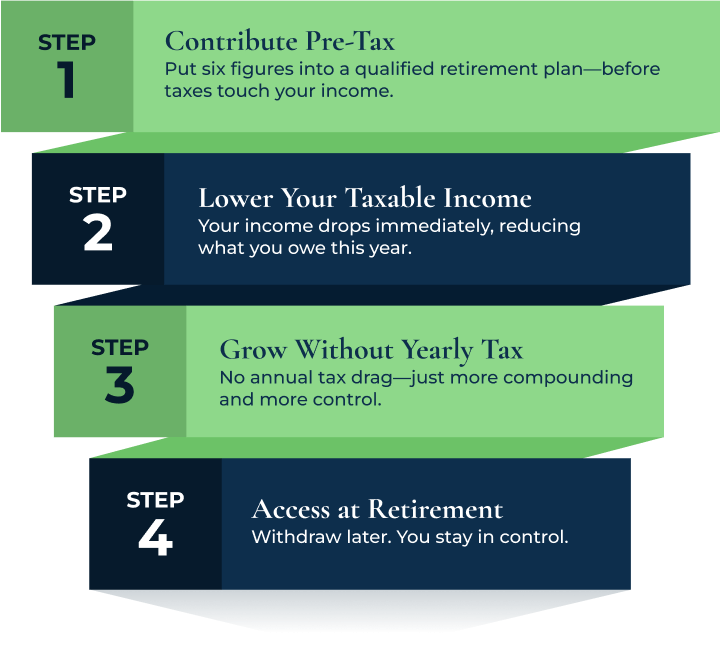

Keep More. Pay Less. Here’s How.

Cash balance plans are simple, powerful, and built for business owners. Here’s how the strategy works, step by step:

What Sets Us Apart

100+ Plans Installed

In just 3 years, by expert financial specialists

Hyper-Focused Niche

One powerful tax strategy, with broad experience across complex entities and business types

-1.png?width=89&height=90&name=Group%20(1)-1.png)

Remote-First, Nationwide Reach

Complete turnkey delivery—wherever you do business

Implementing a Cash Balance Plan gave me more confidence and flexibility. I saved $108K in taxes last year alone, and it’s opened up new options—especially if I decide to scale back or step away from practicing full-time. The process was smooth, and the results speak for themselves.

— Trust and Estate Attorney in Minnesota

Wondering how it would look for you?

We’ll review your income, goals, and business structure and give you a clear answer. No pressure. Just straightforward advice based on your numbers.

FAQs

Can I do this if I have employees?

Yes. Plans must include eligible employees. They’re typically most effective for businesses with fewer than 10 full-time non-family / non-owner employees.

What’s the catch? Why doesn’t everyone do this?

There’s no catch. Many business owners are simply unaware these plans exist—or assume they’re only for large firms. For high earners with lean teams, they’re often a perfect fit.

Do I have to contribute the same amount every year?

The contributions made to the plan can always be lower and sometimes can be scaled higher. Just let us know what you want to contribute and as long as it is within IRS limits, the amount will work. The contributions can be flexible in amount from year to year and amongst the ownership group.

What if I already have a 401(k) or SEP IRA?

A Cash Balance Plan can be added alongside existing 401(k) plans but would replace a SEP IRA.

What kind of business entity do I need?

We work with S corporations, LLCs, sole proprietors, and partnerships. During your consult, we’ll review your setup and confirm what’s eligible.

What does your team handle?

We oversee everything—plan design, IRS filings, compliance testing, investment management, and annual reviews. You get one experienced team and a single point of contact.

I already have a CPA. How do you work with them?

We work directly with your CPA or tax attorney. We coordinate directly with your tax advisor. Our team handles the plan logistics while your advisor ensures tax alignment. It’s a collaborative, streamlined approach.

Is this approved by the IRS?

Yes. Cash Balance Plans are fully IRS-qualified retirement plans when properly structured and administered.

How do I know if I’m a good candidate?

Start with a feasibility call. We’ll run your numbers, discuss your business goals, and give you a clear, objective recommendation—without any pressure.

Still Have Questions?

Let’s find out if the cash balance plan could work in your favor. Book a 15-minute feasibility call or join an upcoming webinar.